Mortgage Recast Calculator

Discover how much you could save by making a lump‑sum payment toward your mortgage principal

Recalculating your mortgage can lead to significant savings. Results are estimates only.

Mortgage Recast Calculator: Unlock Instant Savings and Lower Payments

Mortgage Recast Calculator helps homeowners visualize how a single lump‑sum payment can dramatically lower their monthly obligations without refinancing. If you’ve ever wondered what does recasting a mortgage mean, you’re in the right place. This in‑depth guide will cover the recast mortgage definition, explore mortgage recast meaning, explain what is a mortgage recast, and show you step‑by‑step how to calculate savings manually. You’ll also learn why a mortgage loan recast might be the best move for reducing payments, and discover how using our tool can simplify the math.

What Is Mortgage Recasting?

A mortgage recast (also known as a mortgage loan recast) occurs when you apply a large, one‑time principal payment to your existing mortgage and ask your lender to re‑amortize the loan. Unlike refinancing, recasting keeps your current interest rate and loan term intact—only the payment schedule changes. The lender recalculates your monthly payment based on the new, lower principal balance and the original remaining term.

Key Terminology

Recast mortgage definition: The official meaning of recasting a mortgage—applying a lump‑sum principal reduction and re‑spreading payments.

Re-amortization: The process lenders use to recalculate monthly payments after a lump‑sum contribution.

Principal reduction: The extra payment you make toward your loan balance.

Why Consider Recasting Instead of Refinancing?

Lower Fees: A mortgage recast fee typically ranges from $150 to $500, far less than closing costs for refinancing.

Stable Rate: You lock in your existing interest rate, avoiding the risk of higher rates.

No Reset of Term: The original payoff date remains unchanged.

Immediate Payment Relief: Your monthly payment drops right away after processing.

If you’re asking “what does recasting a mortgage mean?”, remember it’s about smoothing out your existing amortization with a fresh principal figure—no new loan, no appraisal, no underwriting.

How Does Mortgage Recasting Work?

Check Eligibility

Most conventional loans qualify; FHA, VA, or USDA loans may have restrictions.

Lenders often require a minimum lump‑sum payment (commonly $5,000–10,000).

Make the Lump‑Sum Payment

Send your principal payment directly to the lender, specifying it’s for recasting.

Pay the Recast Fee

A one‑time fee covers administrative costs (order of $200–$400).

Re‑Amortization

Within 30–60 days, the lender sends a new amortization schedule and reduced monthly payment amount.

Manual Calculation: How to Compute a Recast by Hand

While our Mortgage Recast Calculator does the heavy lifting, understanding the calculation helps you see the impact:

Original Loan Details

Principal (P₀)

Annual interest rate (r)

Remaining term in months (N)

New Principal

P₁ = P₀ – LumpSum- Monthly Interest Rate

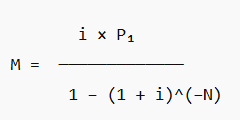

i = r / 12 - New Monthly Payment Formula

5. Total Interest Saved

-

-

Compute total interest before and after recast by summing M × N – principal.

-

Example Calculation

-

Original balance: $50,00,000

-

Rate: 6% (0.06 annual → 0.005 monthly)

-

Remaining term: 240 months (20 years)

-

Lump‑sum payment: $5,00,000

-

New Principal: $50,00,000 – $5,00,000 = $45,00,000

-

Monthly Rate: 0.06 / 12 = 0.005

-

New Payment:

M = 0.005 × 45,00,000 ÷ [1 – (1 + 0.005)^–240] ≈ ₹32,779

This manual approach highlights exactly how “mortgage recast” savings materialize.

Comparing Recast vs. Refinance

| Feature | Recast Mortgage | Refinance Mortgage |

|---|---|---|

| Interest Rate | Unchanged | New rate (could be higher or lower) |

| Fees | $150–$500 | 2–6% of loan amount |

| Credit Check | No | Yes |

| Loan Term | Same | Reset to new term |

| Speed | 1–2 months | 30–45 days |

Pros and Cons of Recasting a Mortgage

Pros

Lower monthly payment without refinancing

Minimal fees and paperwork

No change to interest rate or term

Cons

Requires sizable cash outlay

Not all loan types eligible

No interest rate reduction

Frequently Asked Questions

What is a mortgage recast?

A mortgage recast is when you make a large lump‑sum payment toward your loan’s principal, and the lender recalculates your monthly payments over the remaining term based on the lower balance—without changing the interest rate or loan term.

What does it mean to recast a mortgage?

Recasting a mortgage means applying a principal lump‑sum payment and then re‑amortizing the loan so that future monthly payments are lower—while your interest rate and payoff date stay the same.

How to recast a mortgage?

Confirm your loan is eligible (usually conventional only).

Make the required lump‑sum payment (often ₹5–10 lakh minimum).

Contact your lender and pay the recast fee (typically a few hundred dollars).

Lender re‑amortizes your loan, and your monthly payments are adjusted.

How many times can you recast a mortgage?

Most lenders do not impose a limit—you can recast multiple times provided you meet their minimum principal payment and fee requirements.

What does it mean to recast a mortgage?

It means you apply a lump‑sum to your loan, and the lender reworks your payment schedule to spread the remaining balance evenly across the original term—lowering each monthly payment.

Link to Related Articles

For deeper dives, be sure to explore:

Mortgage Recast Explained: What It Is, How It Works & Why It Matters

Mortgage Recast Policies: Comparing Major Lenders (PNC, Mr. Cooper, Freedom, US Bank, AmeriHome)

Mortgage Recast Calculator: See Your Potential Payment Savings

Mortgage Recast: Advanced Questions Answered (Costs, Limits, Eligibility)

Before you go, here’s a quick overview of our calculator’s powerful features:

Instant Savings Preview

See immediately how a lump‑sum payment lowers your monthly payment, total interest, and overall timeline—no waiting.

Break‑even Analysis

Know exactly how many months it takes to recoup any recast fees, so you’re never caught off‑guard by upfront costs.

Customized Payoff Date

Enter your next payment date and remaining term to get a precise calendar date for your mortgage payoff.

Detailed Interest Insights

Compare total interest owed before and after the recast to understand the full financial impact of your extra payment.

Flexible Term Entry

Separate “Years” and “Months” fields let you represent any remaining term combination—perfect for mortgages with non‑standard schedules.

Built‑In Calendar Picker

A native date control makes selecting your next payment date fast and foolproof on desktop or mobile.

Responsive Design

Inputs and results adapt seamlessly between desktop (side‑by‑side view) and mobile (stacked full‑width fields), so you never lose context.

On‑Demand Guidance

Hover‑over tooltips on every input explain exactly what data to enter—ideal for first‑time users or complex loan terms.

[…] By understanding these core concepts—from the recast mortgage definition to the mortgage recast meaning—you’ll be equipped to decide whether recasting is the smart financial move for your homeownership journey to calculage mortgage recasting quickly refer this calculator here. […]

[…] For Quick Mortgage Calculation Check out This Calculator. […]

[…] For Quick Mortgage Recast Calculation Must Visit This Calculator. […]

[…] ➡️ Mortgage Recast Calculator (evaluate loan adjustments alongside your capital projects) […]